I have a guest post for you today from Anton Ivanov of DealCheck, and today's article is on 5 things you should check before buying your next rental property.

Whether you are buying your first rental property or buying your next rental property, these tips will help you make choices that will positively affect your bottom line.

5 Things You Should Check Before Buying Your Next Rental Property

Most experienced real estate investors will tell you that you make your money when you buy rental properties.

It seems a bit counter-intuitive, but it’s actually spot-on. While there ARE things you can do to improve a property after you purchase it, most of the factors (likes its location, layout and potential rental income) are “locked-in” the moment you buy it.

With that in mind, it’s obvious why you should be picky when buying investment properties and spend appropriate time analyzing each rental before buying it.

Here are 5 Things You Should Always Research and Check Before Pulling the Trigger.

1.The Type of Neighborhood It Is In

Location has a huge impact on the type of tenants you’ll attract, the market rents and the long-term stability of your rental income. This is really important when buying your next rental property.

As a buy & hold investor with a long-term outlook, I prefer to buy rental properties in the “middle of the market” – not in the expensive A-class areas, but not in the C or D-class “slums” either.

I stick with the bread and butter B-class neighborhoods, that tend to have the best ratio of affordable home prices and good tenant quality. These areas often have low crime rates, stable working families and decent schools – all of which will help you generate consistent rental income for years to come.

City-Data and Neighborhood Scout are great websites to conduct preliminary neighborhood research, although I’d strongly suggest visiting the city and neighborhood in-person if you don’t already live there.

2. The Age of the Home

It’s easy to overlook this important detail, but how old the property is will have a big impact on your ongoing  maintenance costs (which you want to keep as low as possible).

maintenance costs (which you want to keep as low as possible).

Homes older than 50-75 years will often have aging electrical systems, plumbing pipes and drain lines, foundation and structure.

Upgrading or repairing these components can easily run in the thousands of dollars and will be a big hit to your net cash flow.

Furthermore, older homes were often constructed with unsafe construction materials (like asbestos), which you may have to replace or at least notify your tenants about.

In short, buying a home built in 1912 isn’t the end of the world, but you should seriously consider the implications that come along with owning it. It makes more sense to buy newer properties, whenever possible.

3. Is the Layout Functional?

Would you live in a house that has barely any room for a fridge, no laundry hookups or hallways so poorly laid out that you can’t get your bed in the bedroom?

Probably not, and neither will potential tenants. You can’t really place a finger of what a “good” interior layout is, but there are definitely some red flags you can watch out for.

When touring the property (or looking at its photos), consider if you would find this home appealing, functional and somewhere where you’d be comfortable living. This is exactly what your potential tenants will be thinking.

Going along these lines, it’s also worth checking if the home’s layout and size fit well into its surrounding neighborhood. If you buy a 1-bedroom, tiny house in a suburban area populated by families, you’ll likely have a hard time getting it rented.

4. Cash Flow Projections

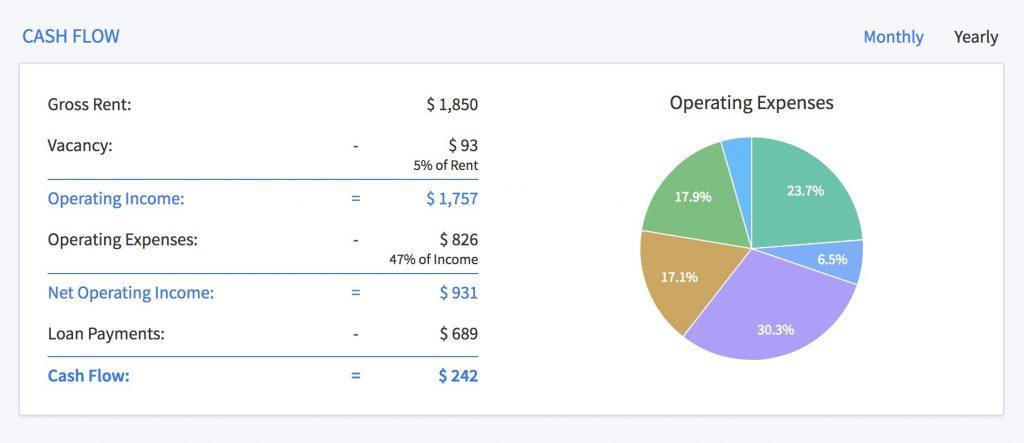

Now we’re getting to the good stuff – estimating the cash flow (in other words, the income), you’ll receive from the rental property. After all, this is the reason you’re buying real estate in the first place, right?

Accurately estimating your potential cash flow is essential to help you compare rental properties against one another and decide whether a particular one is a good investment.

First, you’ll need to figure out the market rent for each property. I like to look at the current lease (if it’s already rented), Rentometer or similar Craigslist listings when doing my research. If you have a local property manager, you can also ask them for an opinion.

Next, write down all of the expenses you expect to have. Don’t forget your mortgage payments, property taxes, home insurance, property management, maintenance & repairs, capital expenditures and utilities.

Some investors like to use the “50% rule” (or similar) to approximate their expenses, but I strongly suggest to itemize them to get more accurate cash flow projections.

Finally, subtract your monthly expenses from the monthly rent to get your estimated monthly cash flow. Don’t forget to account for vacancies you expect to have. You can use an online calculator like DealCheck to help you crunch the numbers faster.

5.Look for Hidden Maintenance Problems

Even newer homes can have significant maintenance issues that the seller is either trying to hide from you or simply doesn’t know about.

To protect yourself, always order a professional home inspection before closing on any rental property.

This will run you a few hundred dollars (depending on the area and the size of the property), but is money well spent. A quick Google search should connect you with several local property inspection companies.

I recommend you accompany the inspector when they’re at the property. This will give you an opportunity to learn from them and ask them to point out and show you the issues they uncover.

After a few days, you’ll get a detailed inspection report describing all of the issues and discrepancies that were found.

Every home will have at least some problems, so don’t sweat too much over the small stuff. What you’re looking for are giant red flags, like foundation/structural problems, major plumbing or electrical issues, poor construction or roof leaks.

Don’t be afraid to walk away from a deal if the problems are severe enough or if the seller is not willing to fix them before closing.

Wrapping Up

Buying rental properties can definitely seem intimidating, with so many different things you have to check, research and verify.

But if you at least remember to check the 5 things described above, you’ll be on your way to buying a great long-term rental.

My thanks to Anton Ivanov founder of DealCheck Software for this very informative guest post. Information is power, especially when it comes to buying rental property. Whether you are buying your first rental property or your next rental property, it pays to be choosy.

When buying your next rental property, you want a property that is not only easy to rent, but one that will get you the highest rent possible for your area.

About Anton

If you want to schedule a 1 on 1 call with me to talk about specific strategies for building your brand and creating more effective marketing for your business, you can do that here by clicking this link.

Have you gotten your freebies and subscribed to the blog? If not be sure to do that today so you don’t miss any of the business building tips I have coming your way. I want this year to be your best year ever!

Thanks for stopping by.

Thanks for sharing this. Some tips are useful!

A very good article you described everything very clearly,it will help those who are planing to buy property

very nice blog. it will be useful for readers and guide people regarding such topics.

This is really a nice article.One can check this to know what is the factor to consider before planning to buy an apartment.Thanks for such a nice article.

Thanks for the article Anton.

Thanks for the opportunity to write this post, Sharon! I’ll be happy to answer any questions your readers have here in the comments.