You know what separates struggling investors from great investors?

2 words. Good Math.

I’m a numbers guy. You live by the numbers or you die by them in the real estate game. Short of divine intervention, no amount of luck, sorcery or practical know-how can save you from a bad property if the numbers simply don’t work.

It’s no secret. It’s just slightly elusive. And honestly, I totally understand how SO MANY landlords fall into this trap.

Most new investors will get an approval letter from the bank saying they can afford a property worth “X” so they calculate their mortgage payments, potential rental income & property taxes and sign on the dotted line.

The truth is, that there is so much more to consider! That’s why I always run all of the numbers before even considering a purchase. While it may be tempting to take shortcuts like using the famous “50% Rule” when vetting properties, shortcuts like this can be disastrous when you’re on the hook for hundreds of thousands of dollars.

Calculating Income

One of the largest mistakes that future landlords can make is to not budget for vacancy.

In an ideal world we would have great long term tenants who always pay on time. But the reality is that people move for work, they purchase their own homes, have children and need more space or they hold your unit hostage during the eviction process.

A good rule of thumb is to plan for 5-8% vacancy rates every year when estimating your rental income.

And remember that the location, price and your screening process plays a huge role in the quality of your tenants! So spending a bit of extra time in the beginning can have a huge impact on your bottom line.

Fixed Monthly Costs

Your fixed expenses should contain all of your expected monthly or re-occurring expenses. It’s incredibly important that you include all of your fixed expenses in your calculations, especially since your water bill, property taxes and insurance rates can vary depending on the property and location.

Here’s a quick list of some common monthly expenses to get you started.

- Mortgage Payment

- Property Taxes

- Homeowners Insurance

- PMI

- Property Management (8-12% of rental income)

- Garbage / Waste Removal

- Water & Sewer

- Gas & Electric

- HOA Dues

- Service calls, Repairs & Scheduled Maintenance

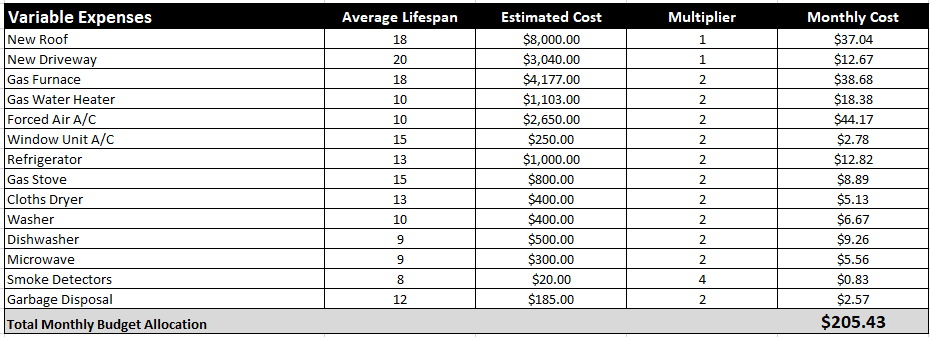

Variable Expenses to Budget For

Variable expenses are the toughest thing to budget for!

While you can usually do a visual inspection on your properties roof or driveway to get an idea of how many useful years of service you can expect before having to deal with a replacement for these items, appliances can be a lot trickier.

Murphy’s law states:

“Anything that can go wrong, will go wrong.”

My best advice for investors is to plan for Murphy ’s Law.

Here’s an excerpt from our Budget spreadsheet for some common variable expenses.

**The estimated costs column are actual national averages for each list item!

Vetting A Property Quickly With The 50% Rule

I know, I know – I dismissed this rule at the beginning of this article.

But you know what? It’s great for quickly narrowing down your list of potential properties! While it should never be the last calculation you do, it’s a great starting point to help you sift through all of your options.

So what is the 50% rule exactly?

“50% of your income (after you’ve paid your mortgage + taxes) should go towards expenses”

For an example, let’s say that we are looking to put 20% down on a $150,000 duplex. After running the numbers through a simple mortgage calculator we come up with the following numbers:

Mortgage = $560

Property Taxes = $304

Potential Rental Income After 5% Vacancy = $1,425.00

Since we’ve already done our basic calculations to figure out our mortgage, property tax and expected rental income for the property we know that our income would be roughly $1,425.00 per month and our mortgage & property taxes would equal $864.00 per month.

So time for some quick math…

$1,425 – $864 = $561

Now we just have to take 50% of our $561 dollars of income to find our estimated cash flow of $280.50 per month.

Surprisingly, this estimated cash flow of $280.50 isn’t super far off from my real world calculation of $153.57 of monthly income on the same property. So while it’s certainly not a perfect rule of thumb, the 50% rule is still a very useful calculation when you are narrowing down potential investment options.

Download the Budget & Expenses Template!

Once you’ve narrowed down your options and are ready to put in an offer, it’s time to roll up your sleeves and do your research.

How much does water & sewer cost per unit in your area? What about garbage? Will you have property management fees? And if so, How much?

Now is the time to sit down and crunch all the numbers to make sure that your $150,000+ investment still makes sense!

Download The Template!

Wrapping Up

“Wealth creation through real estate starts with correct math” – Brandon Turner

The single biggest thing you can do to improve your wealth creation machine is to simply know your numbers. You can make small adjustments on the fly to deal with issues with property management, repairs or even problem tenants. But you can’t will your way into making a cash flow negative property lucrative.

Budget for ALL your expenses. Budget for Murphy’s Law. Budget for Success.

Over to you!

I’d love to hear from you in the comments. Got any advice that you think should also be on this list?

Thanks to John Connor for this informative guess post.

About John Connor

John is passionate about renovating old and outdated properties and turning them into awesome & profitable homes. When he is not busy fixing things, you can usually find him crunching numbers on properties or writing helpful advice for aspiring landlords over at MyModernHome.net.

John is passionate about renovating old and outdated properties and turning them into awesome & profitable homes. When he is not busy fixing things, you can usually find him crunching numbers on properties or writing helpful advice for aspiring landlords over at MyModernHome.net.

I’ve put together this post to help you identify future pitfalls so you can buy your first property with total confidence.

If you would like to schedule a 1 on 1 call with me to talk about specific strategies for building your brand and creating more effective marketing for your business, you do that here by clicking this link.

Have you gotten your freebies here on the blog? If not be sure to do that today so you don’t miss any of the business building tips I have coming your way. I want this year to be your best year ever! And if you enjoyed this article, please share it.

Thank you for sharing such an informative post with your readers. My planning of investing in real estate got better with your ideas. Keep posting and keep us updated.

Thanks for stopping by.

Thanks for sharing this post. We used to be in a real estate business and reading such this type of article can help us a lot.